If you become injured or disabled due to work or a serious health condition, Canada offers multiple support systems to help you recover and maintain income. Understanding how these benefits work—and how they interact—is essential for protecting your rights and your finances.

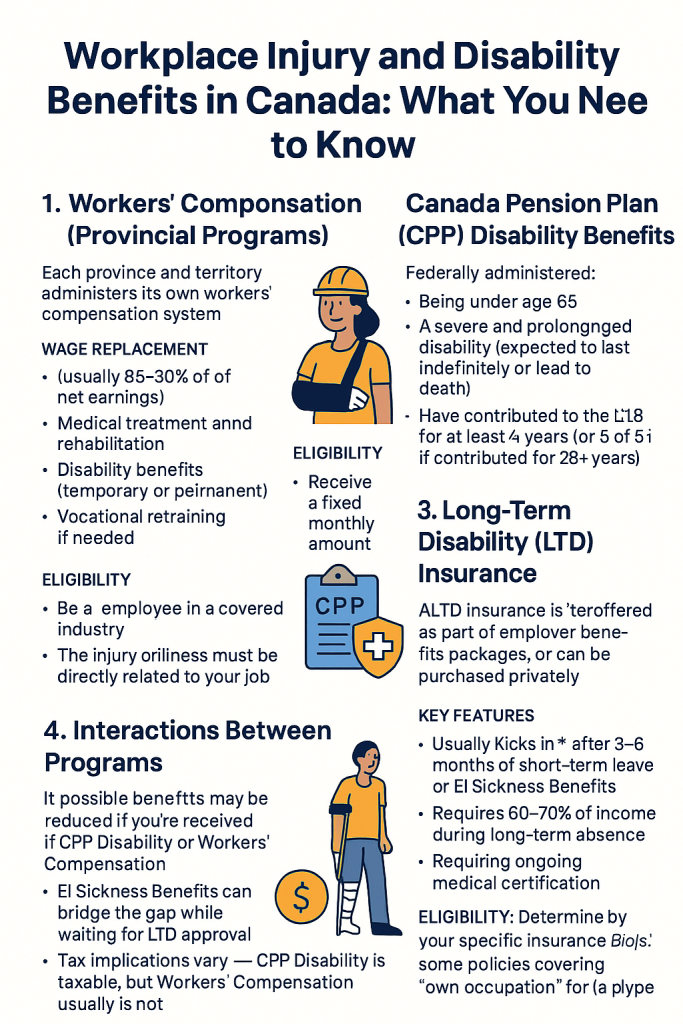

1. Workers’ Compensation (Provincial Programs)

Each province and territory in Canada administers its own workers’ compensation system, designed to support employees who suffer job-related injuries or illnesses.

What It Covers

- Wage replacement (usually 85–90% of net earnings)

- Medical treatment and rehabilitation

- Disability benefits (temporary or permanent)

- Vocational retraining if needed

Eligibility

- You must be an employee in a covered industry.

- The injury or illness must be directly related to your job.

- You must report the injury promptly to your employer and the compensation board.

Example: Lisa injures her wrist at work and is approved for benefits through her provincial board (e.g., WSIB in Ontario).

2. Canada Pension Plan (CPP) Disability Benefits

If your disability is long-term or permanent and prevents you from working, you may qualify for CPP Disability Benefits, which are federally administered.

Eligibility Criteria

- You must be under age 65.

- Have a severe and prolonged disability.

- Have contributed to CPP in at least 4 of the last 6 years.

What You Receive

- A fixed monthly amount + a percentage of your average CPP earnings.

- Average monthly payment is approx. $1,100–$1,300 (2025).

3. Long-Term Disability (LTD) Insurance

Many employers offer Long-Term Disability (LTD) insurance as part of their benefits package.

Key Features

- Usually kicks in after 3–6 months of EI or short-term leave.

- Replaces 60–70% of income.

- Requires ongoing medical certification.

Eligibility

- Defined by your insurance policy.

- Coverage type: “own occupation” or “any occupation”.

4. Interactions Between Programs

- LTD payments may be reduced if you also receive CPP Disability or Workers’ Compensation.

- EI Sickness Benefits can bridge the gap while waiting for LTD.

- Tax implications vary—CPP Disability is taxable, Workers’ Compensation often is not.

Example: Mark is injured at work and receives workers’ comp. After a year, he also qualifies for CPP Disability, reducing his LTD benefits slightly.

Key Takeaways

- Workers’ Compensation supports job-related injuries (provincial).

- CPP Disability helps if you cannot work at all (federal).

- LTD insurance replaces a higher portion of income (private/employer).

- Benefits can be combined, but coordination is key.