Canada offers one of the most comprehensive child benefit systems in the world. For families living here, especially new immigrants, understanding and accessing these benefits can make a substantial difference in managing the costs of raising children.

This article provides a clear overview of the major federal support programs available to families with children in Canada, focusing on the Canada Child Benefit (CCB) and related initiatives.

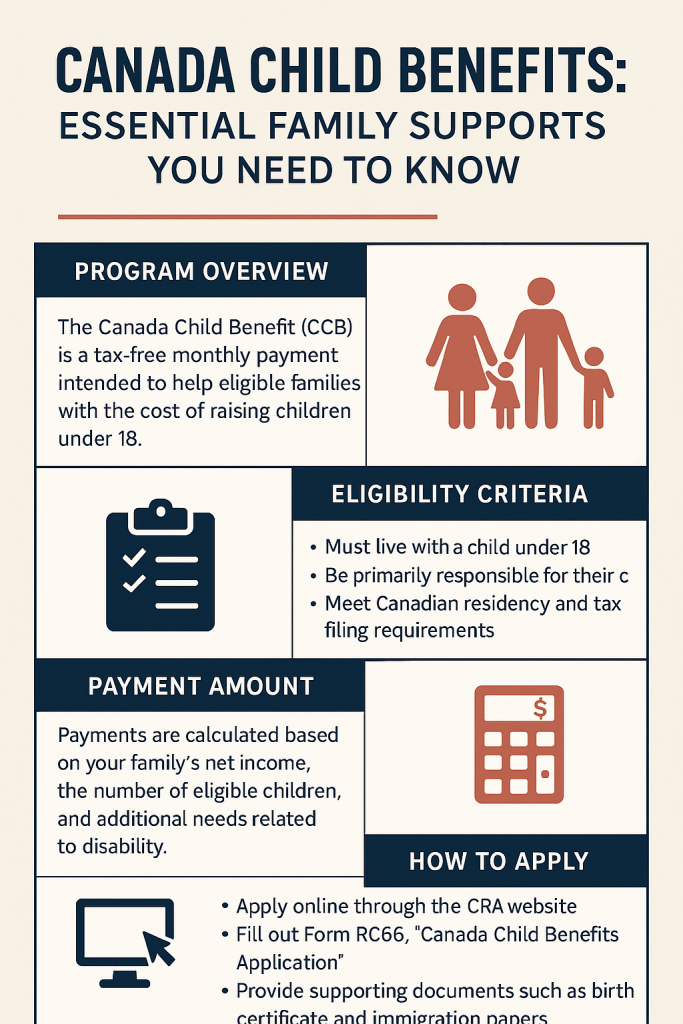

Overview of the Canada Child Benefit (CCB)

The Canada Child Benefit (CCB) is a tax-free monthly payment provided to eligible families to help with the cost of raising children under 18 years of age. Administered by the Canada Revenue Agency (CRA), the CCB is income-based, meaning the amount a family receives depends on their net income and the number of children in their care.

In 2025, families may receive up to approximately $7,800 per year for each child under six and around $6,600 per year for each child aged 6 to 17. These figures are adjusted annually to reflect inflation.

Additional Support: The Child Disability Benefit (CDB)

Families caring for a child with a severe and prolonged impairment in physical or mental functions may be eligible for the Child Disability Benefit (CDB). This is a supplementary payment on top of the CCB. Eligibility for the CDB requires approval for the Disability Tax Credit (DTC), which involves a medical certification process.

Eligibility Requirements

- Live with the child and be the primary caregiver

- Be a resident of Canada for tax purposes

- Either the applicant or their spouse/common-law partner must be a Canadian citizen, permanent resident, protected person, or temporary resident who has lived in Canada for the previous 18 months

Annual tax filing is essential. Even if there is no income to report, failing to file taxes can result in losing eligibility for the benefit.

How to Apply

- Through the CRA’s My Account portal

- By completing Form RC66 and submitting it by mail

- Automatically, in some provinces, when registering the birth of a child

Applicants should ensure that all required documentation is complete and accurate to avoid delays in processing.

Integration with Provincial and Territorial Programs

Several provinces and territories offer additional child and family benefits that are integrated with the CCB system. For example:

- Ontario Child Benefit (OCB): Supports low- to moderate-income families with children under 18

- Alberta Child and Family Benefit (ACFB): Provides financial assistance to lower-income families regardless of employment status

These programs use information from the CCB application and tax returns to assess eligibility, meaning no separate application is usually required.

Conclusion

The Canadian child benefit system is designed to support families in providing stable, healthy environments for children. By understanding how the CCB and related programs work, families can ensure they receive all the assistance to which they are entitled. Regular tax filing, accurate information, and timely applications are key to accessing these valuable supports.