Buying your first home can feel overwhelming—especially with rising housing costs across the country. That’s where the First-Time Home Buyer Incentive (FTHBI) came in: a federal program designed to help Canadians reduce their monthly mortgage payments by giving them a head start on their down payment.

Though the program stopped accepting new applications as of March 31, 2024, its structure and goals are still important to understand—especially when paired with provincial housing support that continues to evolve.

What Was the First-Time Home Buyer Incentive?

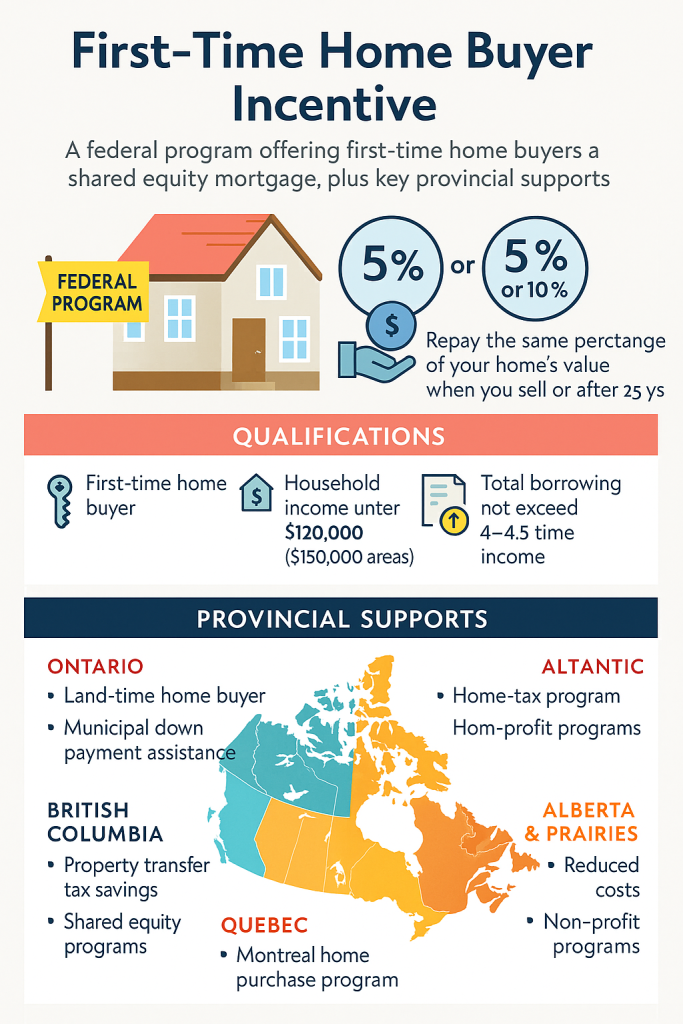

The FTHBI was a shared equity mortgage offered by the Government of Canada. If you were eligible, you could receive:

- 5% of the purchase price for a resale home

- 5% or 10% for a newly built home

The amount was interest-free, meaning you didn’t pay monthly payments on it. However, when you sold the home or after 25 years—whichever came first—you had to repay the government the same percentage of your home’s value at that time (not the original dollar amount). So, if your home appreciated in value, the repayment amount increased proportionally.

Who Qualified?

To be eligible for the FTHBI, buyers had to:

- Be first-time homebuyers

- Have a household income under $120,000 (up to $150,000 in certain high-cost areas)

- Have a total borrowing amount that didn’t exceed 4 to 4.5 times their income

- Have at least the minimum down payment required by mortgage rules

Provincial Variations and Additional Programs

While the federal incentive is no longer available, many provinces continue to offer their own support for first-time buyers:

Ontario

- Land Transfer Tax Refund: Up to $4,000 back for first-time buyers

- Affordable Home Ownership Program: Municipal-level down payment loans

British Columbia

- First-Time Home Buyers’ Program: Property transfer tax exemptions on homes under $500,000

- Shared equity programs via BC Housing

Quebec

- Montreal Home Ownership Program: Grants up to $15,000 based on family status

- Provincial Tax Credit for Home Buyers: Up to $750

Alberta & Prairie Provinces

- No land transfer tax

- Some cities offer down payment assistance via non-profit organizations

Atlantic Provinces

- Programs vary by municipality (e.g., property tax breaks, grants)

- Prince Edward Island offers down payment support to low-income buyers

Why It Still Matters

Even though the FTHBI is now closed, its structure may influence future housing policies. Many provincial programs still mirror its core ideas: helping first-time buyers afford homes through reduced upfront costs or shared equity.

If you’re looking to buy your first home, it’s worth exploring local incentives—some of which can be combined with the Home Buyers’ Plan (HBP) or the First Home Savings Account (FHSA) for maximum benefit.