Canada offers a range of public and employer-sponsored benefits—from Employment Insurance (EI) to health plans and retirement savings—but many people don’t use them to their full potential. Whether you’re a new employee, switching jobs, or dealing with time off due to illness or family needs, understanding how to strategically navigate your benefits can make a major financial difference.

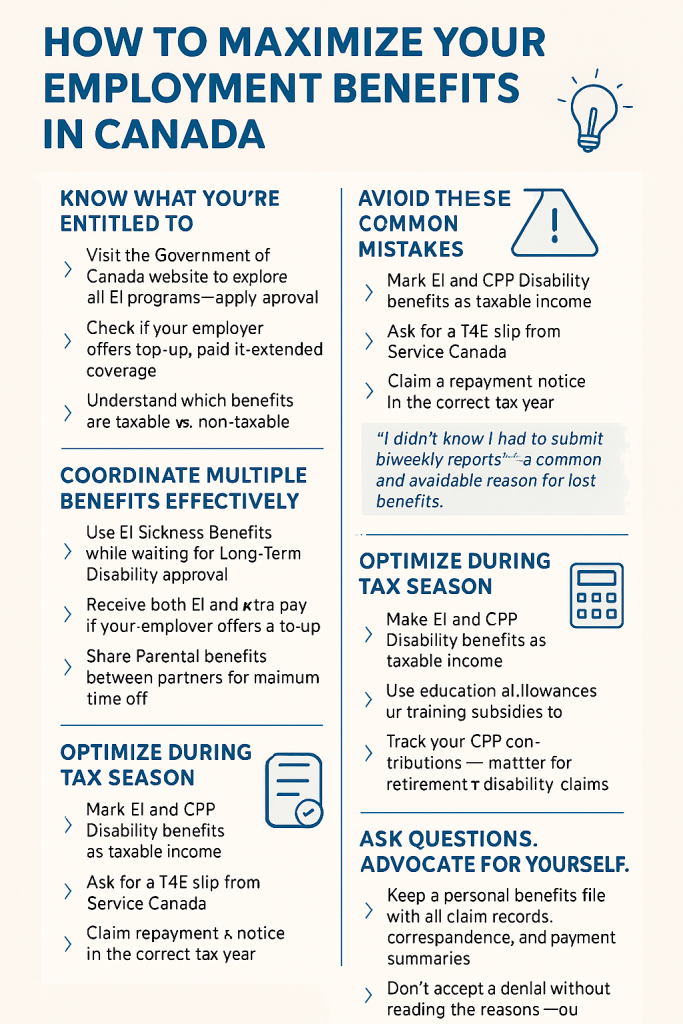

Know What You’re Entitled To

- Explore all EI programs: regular, sickness, parental, caregiving.

- Check your employer’s benefits: top-ups, paid leave, extended coverage.

- Understand what’s taxable vs. non-taxable (e.g., CPP Disability vs. Workers’ Comp).

Tip: Read your company’s employee handbook or benefits booklet thoroughly.

Coordinate Multiple Benefits Effectively

- Use EI Sickness while awaiting Long-Term Disability (LTD) approval.

- Pair employer top-up plans with EI to maximize income.

- Split parental benefits between partners for more flexibility.

Example: Emma uses 15 weeks of EI Sickness Benefits during treatment, followed by LTD. She avoids income gaps with proper documentation.

Avoid These Common Mistakes

- Missing application deadlines (e.g., 4-week window for EI)

- Lacking proper medical documentation

- Assuming automatic coverage—many plans need activation

- Failing to report part-time work while on EI

Reminder: Submit your biweekly reports to keep benefits flowing!

Optimize During Tax Season

- EI and CPP Disability benefits are taxable—get your T4E slip.

- Report repayments in the correct tax year.

Pro Tip: A tax advisor can help if you’ve received multiple benefits types.

Think Long-Term: Retirement and Career Security

- Take advantage of RRSPs and pension matching.

- Use education/training allowances to upskill.

- Track your CPP contributions for future claims.

Ask Questions. Advocate for Yourself.

- Reach out to HR or Service Canada if unclear.

- Keep a personal benefits record file.

- Appeal denials—you often have options.

Empower yourself: Informed workers make the most of their benefits.

Key Takeaways

- Get informed: Don’t miss out on what you deserve.

- Combine benefits strategically.

- Avoid common mistakes like missed deadlines or poor paperwork.

- Use benefits to support both your present and your future.