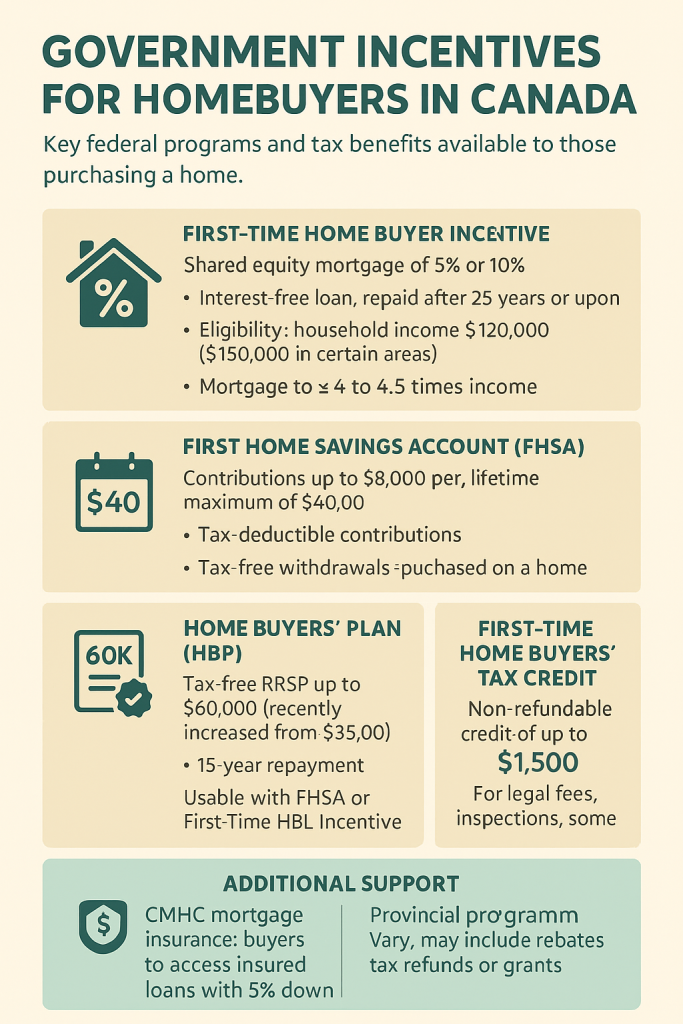

For individuals planning to purchase a home in Canada, especially first-time buyers, the federal government offers a range of financial incentives and tax benefits to ease the cost burden and encourage homeownership. These nationwide programs are designed to improve affordability, support savings, and reduce monthly mortgage obligations.

Key Federal Programs for Homebuyers

1. First-Time Home Buyer Incentive

The First-Time Home Buyer Incentive offers a shared equity mortgage of 5% or 10% of the home’s purchase price. This interest-free loan reduces the size of your mortgage, effectively lowering monthly payments. Repayment is required after 25 years or when the property is sold, with the amount adjusted based on the home’s value at that time.

Eligibility criteria include:

- Household income of $120,000 or less ($150,000 in some urban centers)

- The mortgage must not exceed 4 to 4.5 times annual income

2. First Home Savings Account (FHSA)

Introduced in 2023, the First Home Savings Account (FHSA) combines the benefits of a TFSA and RRSP. Contributions up to $8,000 per year, with a lifetime maximum of $40,000, are tax-deductible, and withdrawals used for a home purchase are tax-free.

This makes FHSA an ideal tool for building a down payment while maximizing tax advantages.

3. Home Buyers’ Plan (HBP)

The Home Buyers’ Plan (HBP) allows first-time buyers to withdraw up to $60,000 from their RRSPs tax-free (recently increased from $35,000). This amount must be repaid over 15 years to avoid tax penalties.

The HBP can be used in conjunction with the FHSA and the First-Time Buyer Incentive for maximum leverage.

4. First-Time Home Buyers’ Tax Credit (HBTC)

Eligible buyers can claim a non-refundable tax credit of up to $1,500, designed to help with closing costs such as legal fees and home inspections. This credit is claimed when filing your annual income tax return (Line 31270).

5. GST/HST New Housing Rebate

Canadians who purchase or build a new home may qualify for a rebate on a portion of the GST or HST paid. The amount varies depending on the province and the value of the home, but it can translate to thousands of dollars in tax savings.

Additional Support: Mortgage Insurance and Provincial Supplements

- CMHC Mortgage Insurance: Allows buyers with a down payment as low as 5% to access insured mortgage loans.

- Provincial Programs: Some provinces offer additional rebates, land transfer tax refunds, or local grant programs. These vary by region and are worth exploring individually.

Final Thoughts

Buying a home in Canada involves significant financial planning, but with federal support mechanisms such as the FHSA, HBP, and various tax incentives, the journey becomes more achievable—especially for first-time buyers. Understanding how to layer these benefits strategically can lead to substantial savings and a more manageable path to homeownership.