Entering retirement should be a time of comfort, not concern. After decades of contributing to society, every senior deserves the reassurance that their financial well-being is supported. In Canada, a range of government programs are in place to help seniors maintain a secure and dignified lifestyle. But navigating these systems can feel overwhelming—especially if you’re unsure where to start or how the benefits work together.

This guide walks you through the main financial supports available to Canadian seniors. Whether you’re planning your retirement or helping a loved one, understanding these programs can help you make informed, confident decisions.

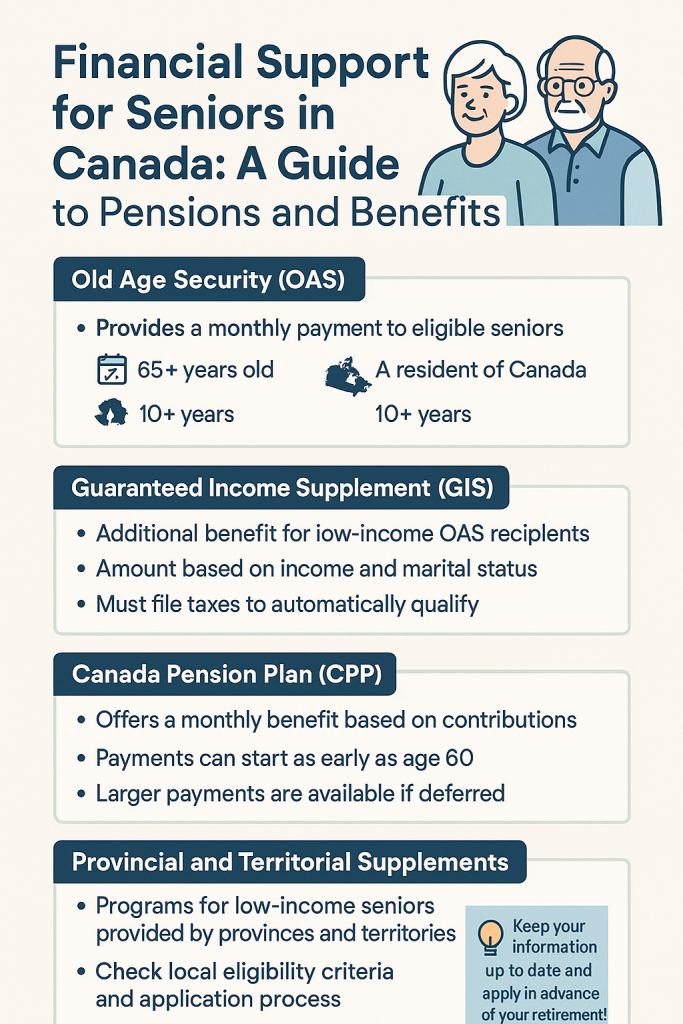

1. Old Age Security (OAS): The Foundation of Senior Income

Who is eligible?

To qualify, you must be:

- 65 years of age or older

- A Canadian citizen or legal resident

- Residing in Canada for at least 10 years since the age of 18

If you’ve lived in Canada for 40 years or more after turning 18, you’ll typically receive the full OAS amount. Those with less time may still qualify for a partial benefit.

How much can you receive?

As of 2025, the maximum monthly OAS payment is around $713, but this is adjusted quarterly based on the Consumer Price Index.

Important: You may need to apply.

Not everyone is automatically enrolled. Service Canada may notify you if you’re eligible for automatic registration, but if not, applying manually is essential—ideally six months before turning 65.

2. Guaranteed Income Supplement (GIS): A Boost for Low-Income Seniors

What is GIS?

GIS is a monthly, non-taxable payment provided to OAS recipients with low incomes. It’s designed to help cover everyday costs like food, utilities, and housing.

Who qualifies?

Eligibility is based on your income and marital status. For instance, a single senior earning less than approximately $21,624 annually may qualify.

How much can you get?

The maximum GIS payment for a single senior can exceed $1,000 per month, depending on income. This is in addition to the OAS.

Why GIS matters:

This supplement can be a lifeline for those who don’t have workplace pensions or large savings. But there’s a catch—you must file your taxes each year, even if you don’t owe anything, as GIS is calculated based on your previous year’s income.

3. Canada Pension Plan (CPP): Your Working Years Paying You Back

Who qualifies?

If you worked in Canada and paid into the CPP (usually through payroll deductions), you’re eligible to start receiving CPP as early as age 60.

How much do you get?

The amount depends on:

- How much and how long you contributed

- The age you begin taking your pension

In 2025, the average monthly CPP retirement payment is around $760, with a maximum over $1,300. If you delay receiving CPP until age 70, your monthly payments increase substantially—about 8.4% for each year past age 65.

Additional CPP benefits include:

- Disability benefit: For those who become severely disabled before age 65.

- Survivor’s benefit: A monthly payment to a deceased contributor’s spouse.

- Children’s benefit: For dependent children of disabled or deceased CPP contributors.

When to start CPP?

If you need the money sooner, starting at 60 is possible. But if you can wait, the increased monthly payments may be worth it in the long run.

4. Provincial and Territorial Supplements: Hidden Gems of Support

Beyond federal programs, each province and territory offers its own layer of support for low-income seniors. These supplements can help top up your income or assist with living costs such as rent or health services.

Here are a few examples:

- Ontario: Guaranteed Annual Income System (GAINS)

- British Columbia: BC Senior’s Supplement

- Alberta: Alberta Seniors Benefit

These programs often require you to be receiving GIS or OAS and to meet specific income thresholds. Application procedures vary, so it’s worth checking with your province’s seniors’ services.

5. Smart Planning: How to Maximize Your Benefits

- File taxes annually. Even if you don’t owe taxes, filing is necessary for GIS and provincial programs. The government uses your return to assess eligibility automatically.

- Consider your CPP start date. Retiring at 60 might seem appealing, but waiting can yield much higher monthly payments. Think about your health, other income sources, and long-term needs.

- Keep your records updated. Notify Service Canada if your address, marital status, or banking information changes. Missing updates could mean missed payments or overpayments you’ll have to repay.

- Use official tools. Canada’s Benefits Finder helps identify programs tailored to your situation.

A Retirement with Confidence

Financial peace of mind in retirement is not just about having money—it’s about knowing what support is available and how to access it. Canada’s system of senior benefits can be complex, but once you understand the basics and take the right steps, it becomes a valuable safety net.

Whether you’re approaching retirement or already living it, take time to review your eligibility, plan your application timeline, and reach out to Service Canada or provincial offices with questions. The system is there to support you—make sure you’re getting everything you deserve.