Many parents wonder how child benefits impact their taxes—do they count as income? Will they affect tax refunds or trigger audits? The short answer: most government benefits for children in Canada are not taxable, but they are deeply tied to your tax return. Here’s how it all works.

Canada Child Benefit (CCB): Non-Taxable, But Tax-Linked

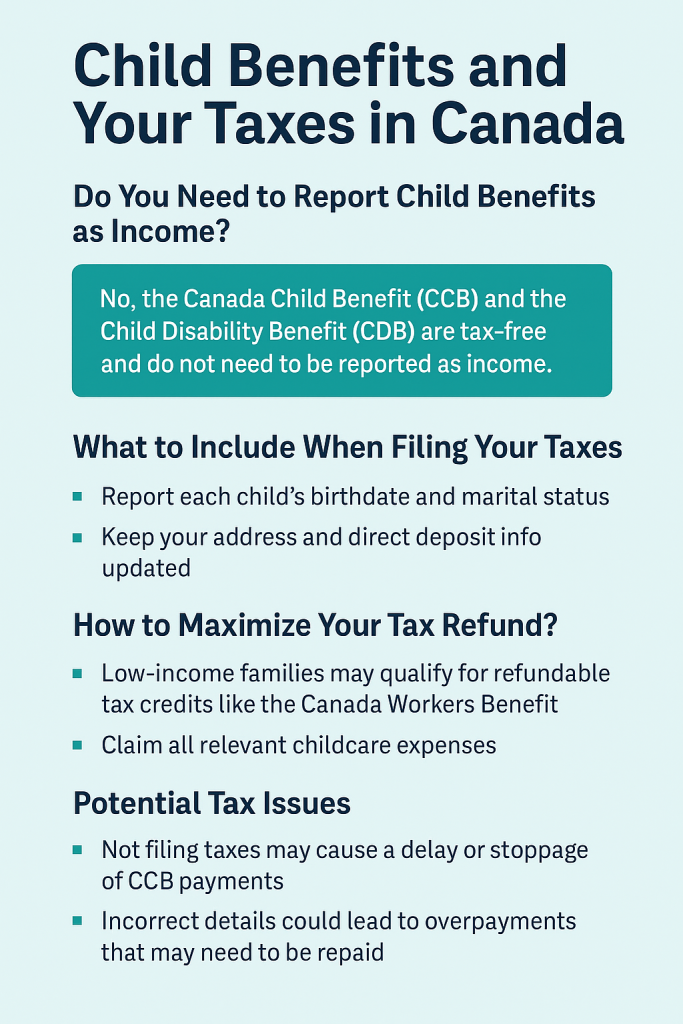

The Canada Child Benefit (CCB) is a tax-free monthly payment. It does not count as income and does not need to be reported on your tax return. However, your eligibility and the amount you receive are based on the income you report on your annual tax return. If you don’t file, you won’t receive the CCB—even if your income is zero.

This means filing your taxes on time each year is essential. Both parents (if applicable) must file, even if only one is earning income.

Provincial Benefits: Similar Tax Treatment

Most provincial and territorial child benefits—such as the Ontario Child Benefit or BC Family Benefit—follow the same pattern as the CCB. They are:

- Tax-free

- Based on your net income from the previous year

- Adjusted automatically each July based on tax return data

Child Support Payments and Taxes

It’s important to distinguish between government benefits and private child support payments. Child support received is not taxable and does not reduce your CCB or other government benefits. Similarly, child support paid is not deductible for the payer.

Tax Credits for Parents

In addition to benefits, there are credits that reduce how much tax you owe:

- Child Care Expense Deduction: Lets you deduct eligible daycare, babysitting, or after-school program costs if you work or study

- Canada Workers Benefit (CWB): Provides a tax refund boost for low-income earners with children

- GST/HST Credit: A quarterly payment that can help offset sales tax, based on your family income

When Your Income Changes

If your income drops suddenly—due to job loss, separation, or health issues—your benefits may not adjust right away since they’re based on the previous year’s income. But you can request a reassessment through CRA’s “Recalculation” process to potentially receive increased support sooner.

Final Thoughts

Canada’s child benefits are designed to support families, not penalize them. While these payments aren’t taxed, your taxes are the key to unlocking them. Keeping up with tax filings and knowing which deductions apply can make a significant difference in your household budget.

For personalized guidance, consider speaking with a tax advisor, especially if your family situation is changing or complex.