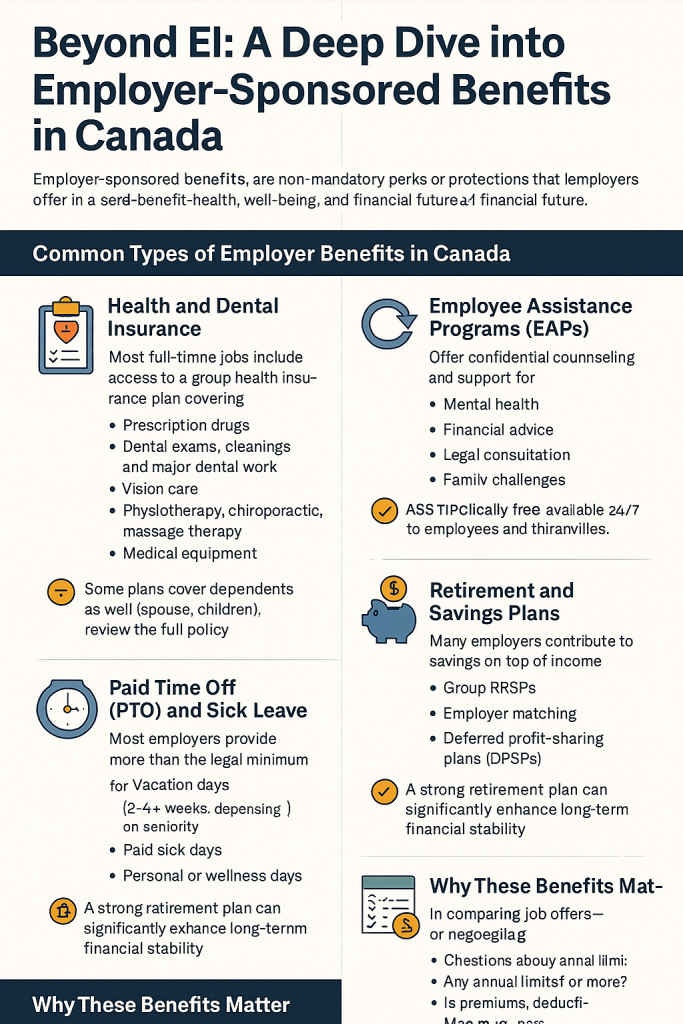

While Canada’s public benefits like Employment Insurance provide a strong foundation, many employers offer additional workplace benefits that significantly enhance financial security and quality of life. These employer-sponsored programs vary widely, but understanding what’s typically offered—and how to evaluate them—can make a big difference when accepting or negotiating a job offer.

What Are Employer-Sponsored Benefits?

These are non-mandatory perks or protections that employers offer in addition to your salary. They’re designed to attract and retain talent while supporting employees’ health, well-being, and financial future.

Common Types of Employer Benefits in Canada

Health and Dental Insurance

- Prescription drugs

- Dental exams, cleanings, and major dental work

- Vision care

- Paramedical services (e.g., massage, physio)

- Medical equipment

Tip: Some plans cover dependents as well, so review your full policy.

Employee Assistance Programs (EAPs)

- Mental health counselling

- Financial and legal advice

- Family and relationship support

Free and confidential, typically available 24/7.

Paid Time Off (PTO) and Sick Leave

- 2–4+ weeks vacation based on tenure

- 5–10+ paid sick days

- Wellness or personal days

Retirement and Savings Plans

- Group RRSPs (Registered Retirement Savings Plans)

- Employer matching contributions

- Deferred profit-sharing plans (DPSPs)

Professional Development and Education

- Tuition reimbursement for courses or certifications

- Conference attendance support

- In-house training programs

Why These Benefits Matter

Benefits can make up 10–20% of your total compensation. Evaluate the full value beyond just salary.

Example: A job offering $5,000 in RRSP matching, $2,000 in dental, and 3 extra vacation days can add several thousand dollars in value annually.

How to Evaluate an Offer

- Health coverage details: what’s included, any limits?

- Cost-sharing: premiums, deductibles, co-pays?

- Retirement benefits: is there matching?

- Time off: how much vacation, sick leave?

- Extra perks: wellness funds, remote work, bonuses?

Tool: Use a compensation comparison chart to estimate the full benefit value.

Final Thoughts

Understanding and leveraging your employer-sponsored benefits can make a major difference in both your financial and personal life. Whether you’re job-hunting, negotiating an offer, or evaluating your current workplace, these benefits should never be an afterthought.