In retirement, every dollar matters. While many seniors live on fixed incomes, the good news is that Canada’s tax system offers a range of credits and deductions specifically designed to lighten the financial load for older adults. Yet, many of these benefits go unclaimed simply because people don’t know they exist—or don’t understand how to access them.

This guide walks you through the most valuable tax credits and deductions available to seniors in Canada. Whether you’re doing your own taxes or getting help, understanding these tools can help you maximize your income and minimize stress.

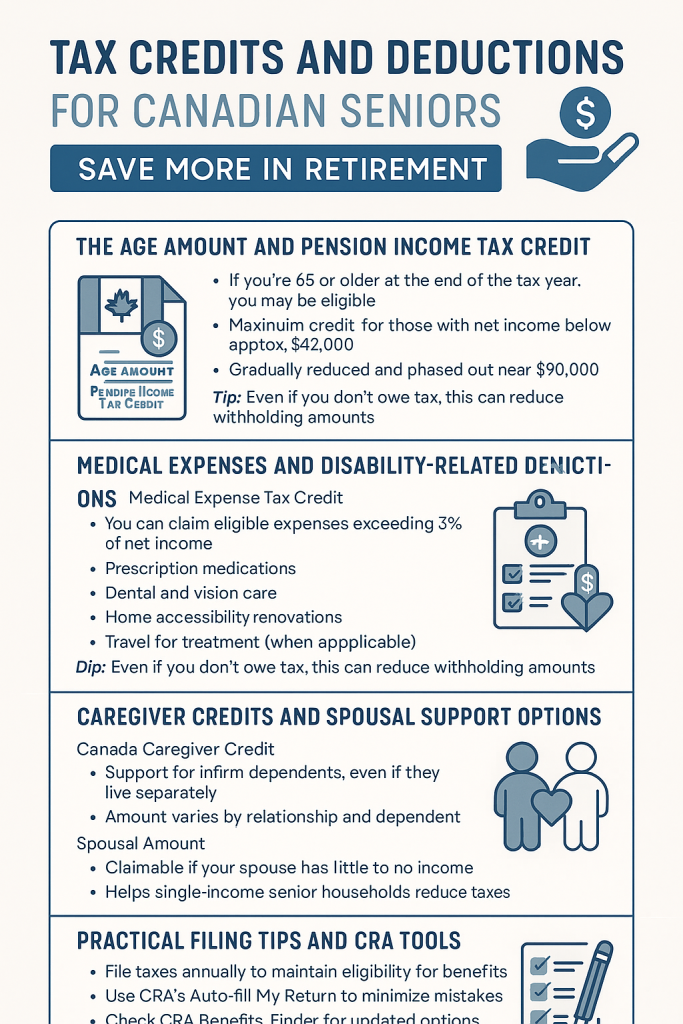

1. The Age Amount and Pension Income Tax Credit

Age Amount

If you’re 65 or older at the end of the tax year, you may be eligible.

- Maximum credit for those with net income below approx. $42,000

- Gradually reduced and phased out near $90,000

Tip: Even if you don’t owe tax, this can reduce withholding amounts.

Pension Income Tax Credit

- Claim up to $2,000 in eligible pension income

- Income splitting with a spouse can amplify tax savings

2. Medical Expenses and Disability-Related Deductions

Medical Expense Tax Credit

You can claim eligible expenses exceeding 3% of net income. Examples:

- Prescription medications

- Dental and vision care

- Home accessibility renovations

- Travel for treatment (when applicable)

Disability Tax Credit (DTC)

- Requires medical certification (Form T2201)

- Can reduce taxes by over $1,300/year

- Retroactive claims for up to 10 years

3. Caregiver Credits and Spousal Support Options

Canada Caregiver Credit

- Support for infirm dependents, even if they live separately

- Amount varies by relationship and dependent income

Spousal Amount

- Claimable if your spouse has little to no income

- Helps single-income senior households reduce taxes

4. Practical Filing Tips and CRA Tools

- File taxes annually to maintain eligibility for benefits

- Use CRA’s Auto-fill My Return to minimize mistakes

- Check CRA Benefits Finder for updated options

- Retain receipts and documentation for 6 years

- Use community tax clinics if professional help is unaffordable

Every Dollar Counts in Retirement

By understanding and claiming the credits and deductions designed specifically for older Canadians, you can reduce your tax burden and keep more of what you’ve earned.

Take the time to review your options, get help if needed, and make tax season work for you—not against you. Retirement should be about peace of mind, not paperwork.